“ Let me tell you about the very rich. They are different from you and me.” – F. Scott Fitzgerald

Let me tell you about the very rich. They are different from you and me.” – F. Scott Fitzgerald

During the 2016 Presidential campaign, Bernie Sanders ran on a platform of calling out economic inequality and student loan debt forgiveness. His target audience was primarily millennials, and it resonated well. A primary that was supposed to be a cake walk for Hillary Clinton turned into an uncomfortably tight race. The Russians also capitalized on this sudden (and unexpected) opportunity by churning out pro-Sanders propaganda, and stoking the narrative that Clinton had “cheated” in the primary.

The fact that Sanders did far better than expected speaks to his message, and perhaps not the messenger. In 2016 he was 75 years old. He is Jewish, atheist, and an avowed socialist who ran for Senator as an independent rather than as a Democrat (though he caucused with them). His appearance and demeanor reminded me of Doc Brown from the “Back to the Future” movies: that manic uncle who explains animatedly to the entire family over Thanksgiving dinner how the nation that controls the supply of molybdenum controls the world.

But, like Doc Brown, he was right.

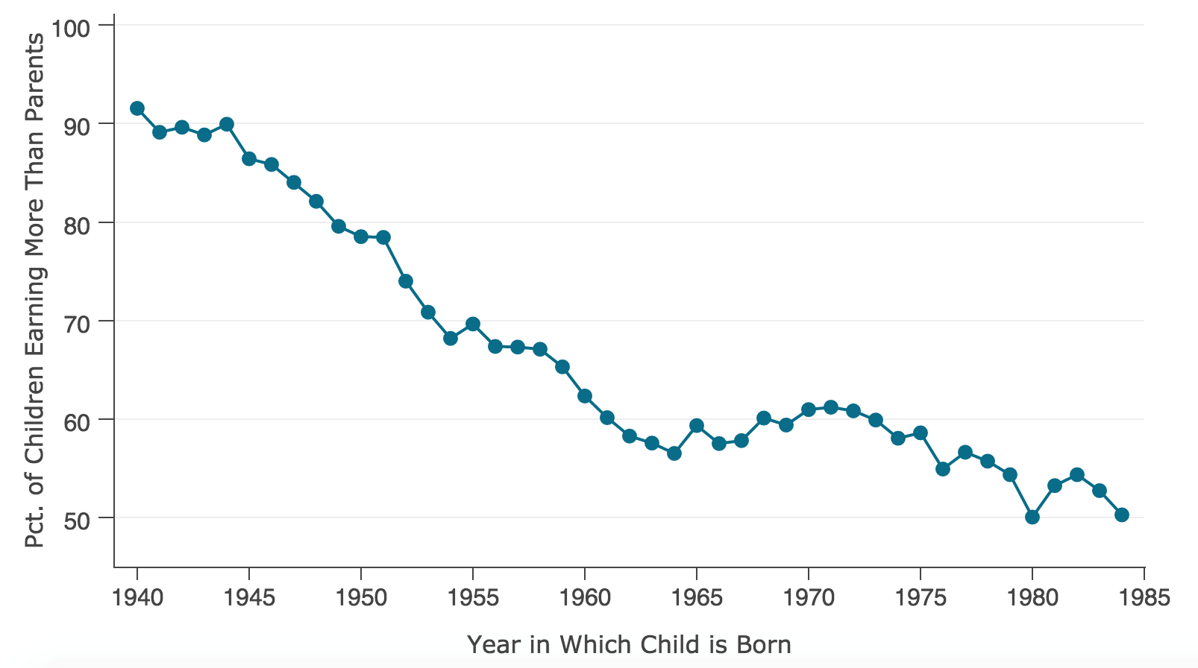

Sanders’ message resonated with younger people because he was the only candidate who correctly identified the root of the problems facing not just younger people, but the country as a whole: wealth inequality. The reason why it worked best with millennials was because they are disproportionately affected by wealth inequality. They are the first American generation to have less than a 50-50 chance of being financially better off than their parents, and the odds are likely to be even worse for Generation Z (people born after 1995 or so).[1]

Before exploring this in depth, the term wealth inequality deserves definition beyond simply “the rich get richer and the poor get poorer.” It is a measure of not only the difference in how much people make every year, but in how much they have accumulated. There are many ways to measure inequality. Commonly used statistical measures of economic inequality include the GINI coefficient (0 if everyone had the same accumulated wealth, and 1 if one person had all the wealth in a nation); income distribution; and household consumption costs.

All of these measures indicate that wealth inequality in the United States has been rising for decades, (GINI coefficient, top 10% share of pre-tax income, top .1% share of pre-tax income, consumption rates etc…) as the figures below show. There is a general consensus among economists that we have entered a second gilded age, with income inequality at a level not seen since the late 1920’s, just before the Great Depression. Even conservative economic think tanks, like the American Enterprise Institute, have noted the trend in their studies.[2]

Figure 5.1. Top 10% Pre-Tax Income Share in the US

Source: Piketty and Saenz (2012)

Figure 5.2. US Gini Coefficient 1946-2014

Wealth inequality exists everywhere, of course. Some people will always have more money than others, and conversely no society will ever exist where a single person has all the money in the country. There is a great deal of space in-between these two extremes, and the GINI coefficient provides a continuous, quantitative measure with which to compare countries against each other, as well states within the US.

Generally speaking, progressive, wealthy socialist countries have the lowest wealth inequality as measured by the GINI coefficient. Among wealthy nations, Nordic countries such as Sweden, Finland, Norway, and Iceland have the lowest levels of economic inequality. Japan, and progressive western nations such as Belgium, Austria, and Denmark also have relatively low levels of wealth inequality.

Conversely, places with high levels of inequality tend to be places that few people would want to immigrate to. High crime, rampant corruption, low life expectancy, poor civil rights records, teeming slums and shanty towns are typical of the countries with very high GINI coefficients. According to the CIA World Fact Book, African nations such as South Africa, Botswana, Namibia, Zambia are among the most unequal on Earth.[3] Among nations with the largest populations Mexico, Brazil, and the United States have some of the highest levels of wealth inequality. Indeed, wealth inequality in the US has risen to a level higher than that of Russia and China, both of which are known for their bloated, corrupt oligarchies.

Conservatives tend to argue that wealth inequality is only natural, and that the benefits (some cheap goods and services and the way in which it incentivizes hard work) outweigh the negatives. However, a review of the relevant literature clearly shows the opposite. Wealth inequality is a leading cause of a wide array of extremely damaging social ills, and prevents people from getting ahead simply through hard work.[4] Indeed, the availability of cheap goods and services in a deeply unequal society means only that those who have wealth can enjoy luxuries like fast food or pointless consumer items.

The 2009 book, The Spirit Level, was written by a pair of British epidemiologists (Wilkinson and Pickett) who wanted to look at the overall societal effects of inequality across a number of wide ranging factors, among them life expectancy, incarceration rates, drug use, homicide rates, and educational performance. First, they compared countries and states using per capita income. Then they repeated to data analysis using measures of inequality. They measured wealth inequality in countries by comparing the ratio of income received by the top 20% to the bottom 20%, using data collected by the United Nations. They made similar comparisons between US states using Gini coefficients as collected by the US Census Bureau.[5]

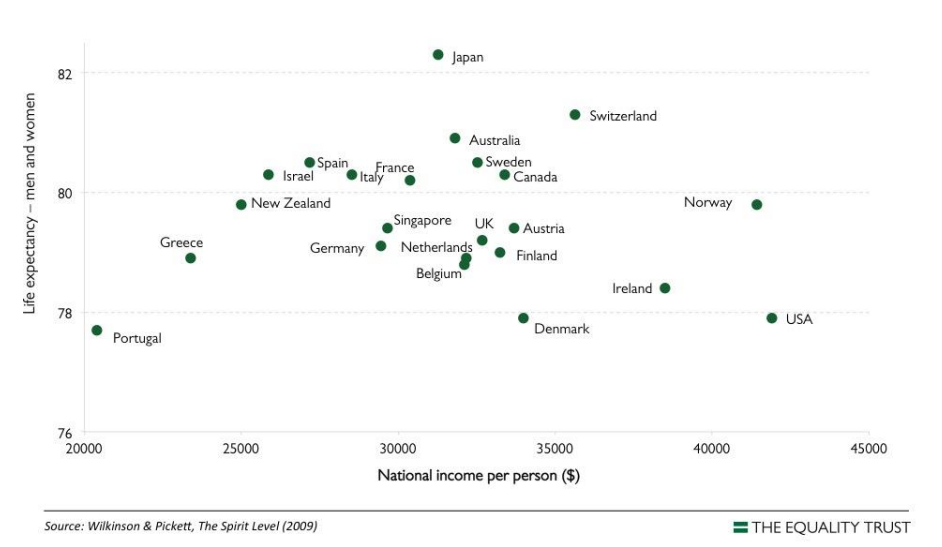

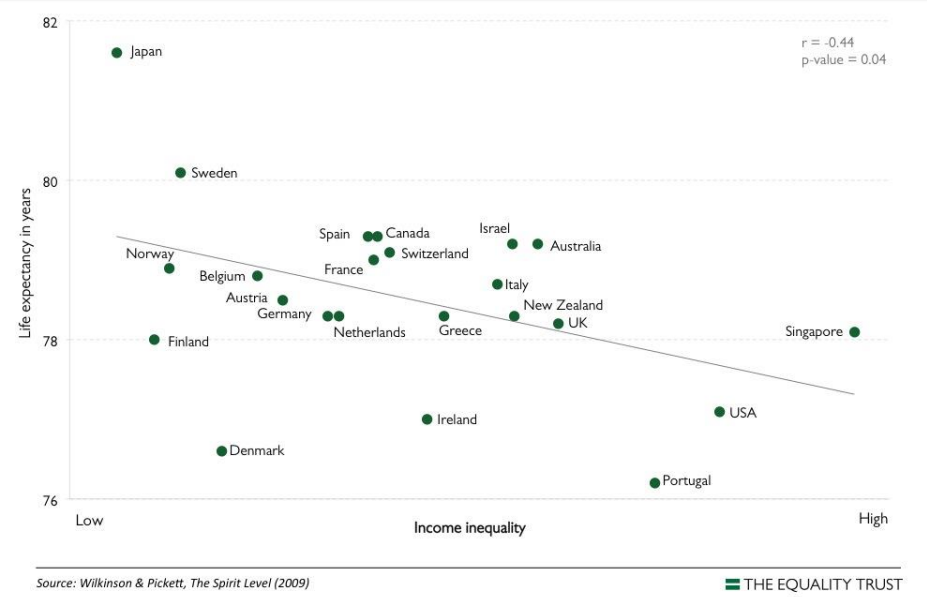

What they showed was startling. When comparing wealthy countries, total wealth had little to no influence on the results. For example, there was not a significant correlation between life expectancy and average income in rich countries. However, there is a significant correlation between life expectancy and wealth equality in these same countries. This pattern held true throughout the data analysis: wealth inequality was predictive of life expectancy, but average income was not.

Figure 5.3 No Correlation between Average Income and Life Expectancy

Figure 5.4 More Equal Countries have Higher Life Expectancies

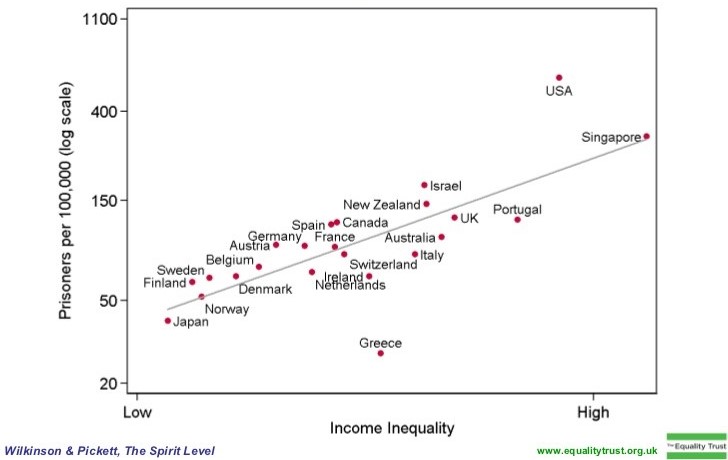

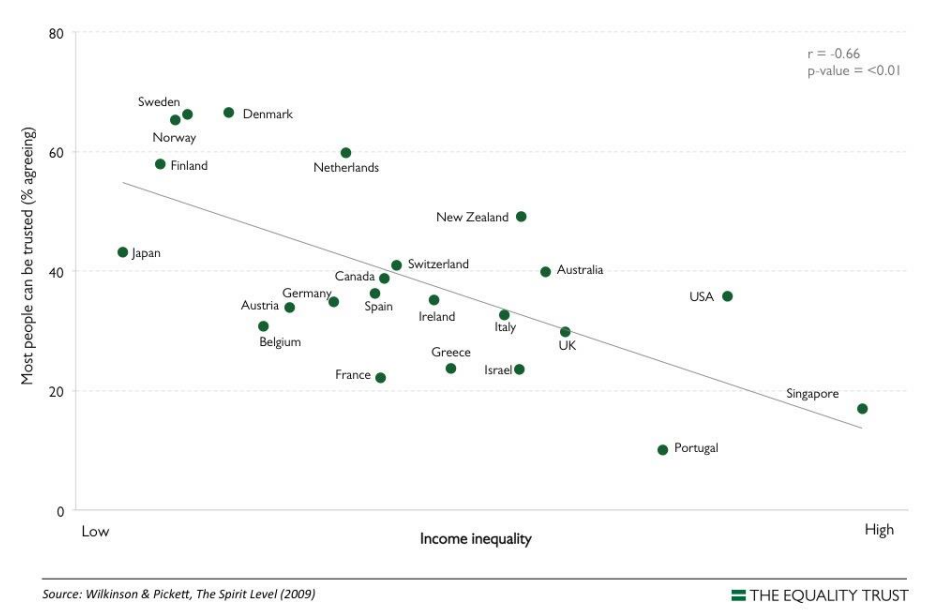

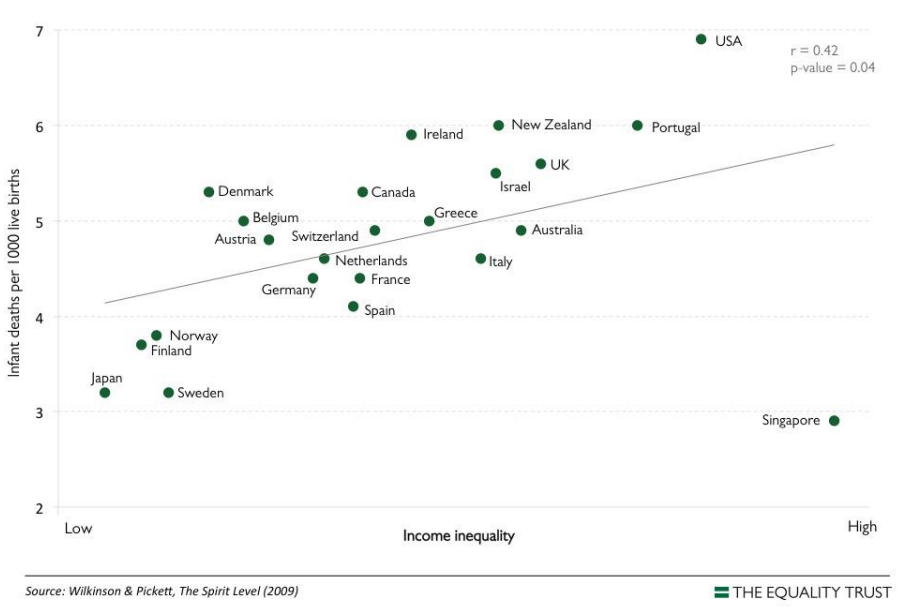

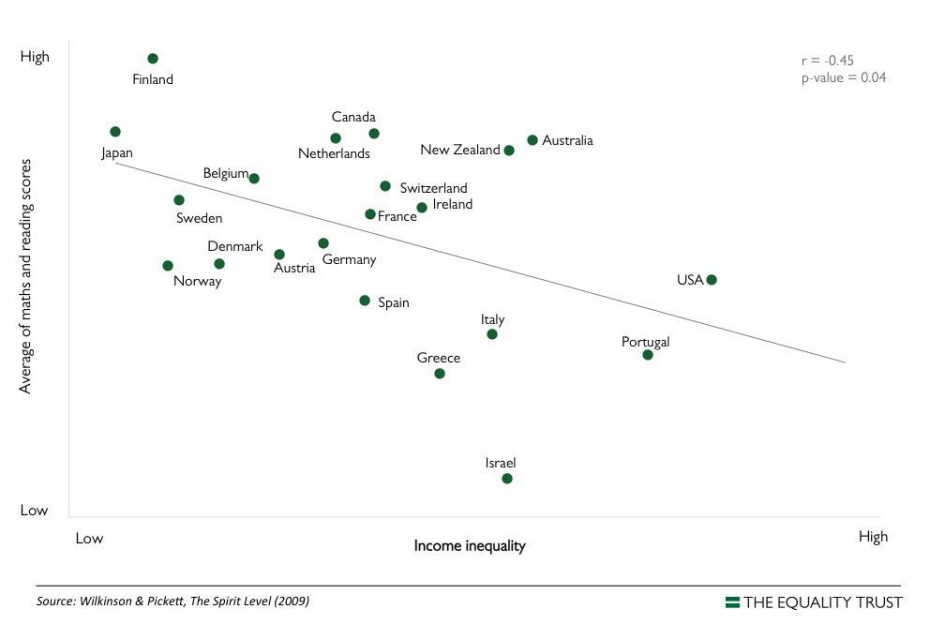

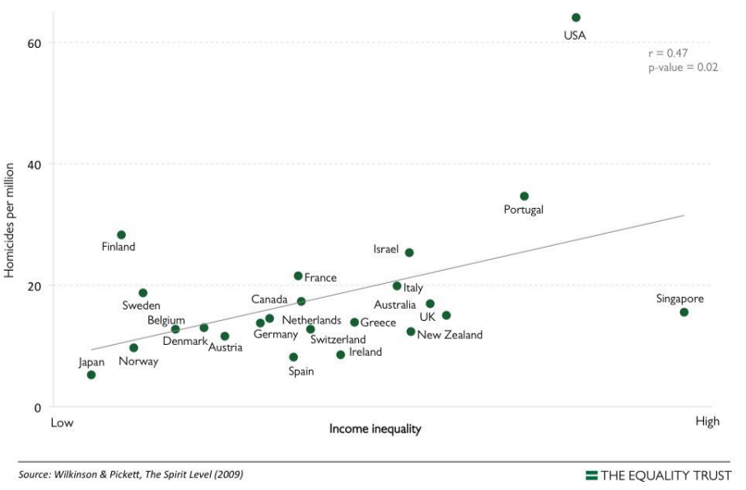

The host of social ills associated with national level wealth inequality are numerous; lower life expectancy, higher incarceration rates, a lower percentage of people who say others can be trusted, higher infant mortality rates, lower scores on standardized tests, more drug use, and higher murder rates.

Figure 5.5 Imprisonment Rates are Higher in Unequal Countries

Figure 5.6. Trust is lower in Unequal Countries

5.7. More Equal Countries have Lower Infant Mortality Rates

5.8. More Equal Countries have Better Educational Outcomes

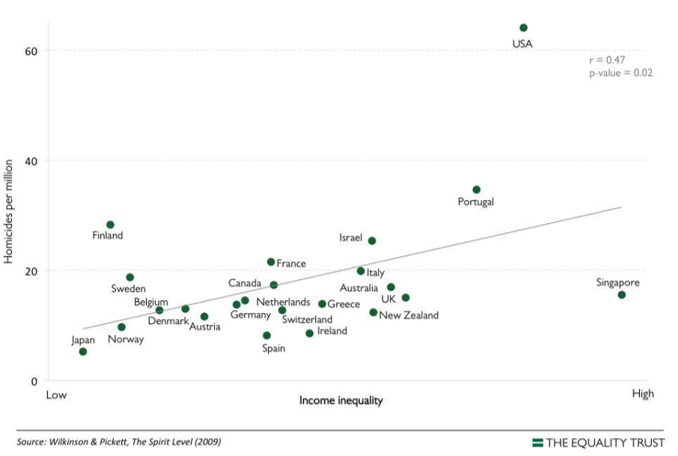

5.9. Homicide Rates are Higher in Countries with More Inequality

You could dismiss these findings by noting that these countries are very different culturally, legally, politically, and economically. However, when the same analyses are performed on a state by state basis within the US, you get the same results. States with higher levels of wealth inequality have worse outcomes across many of the same metrics (life expectancy, incarceration rates, educational attainment, etc…). Thus, it isn’t the culture, or the location, or the political structure responsible. It seems to be the unequal distribution of wealth.

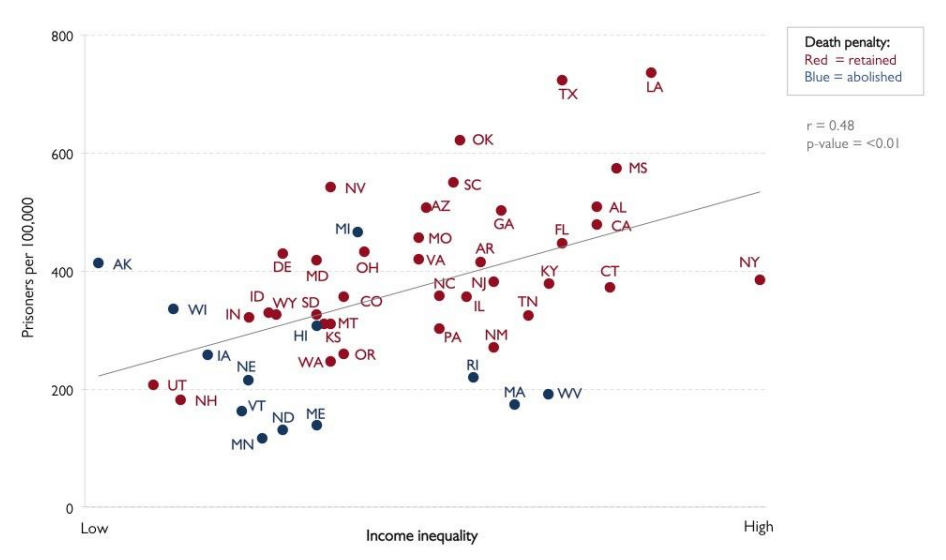

Figure 5.10. Imprisonment Rates are Higher in Unequal States

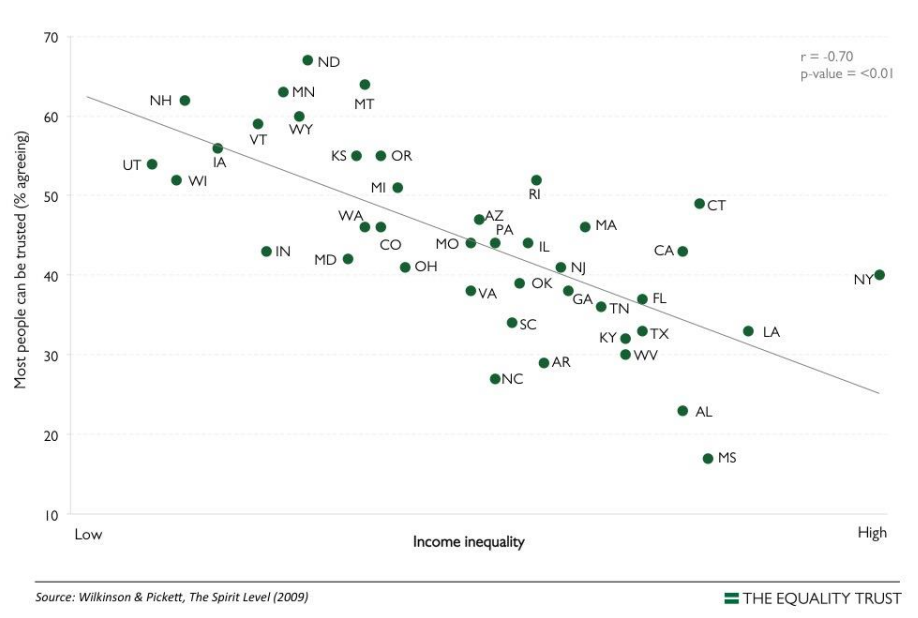

Figure 5.11. Trust is higher in US states with less Wealth Inequality

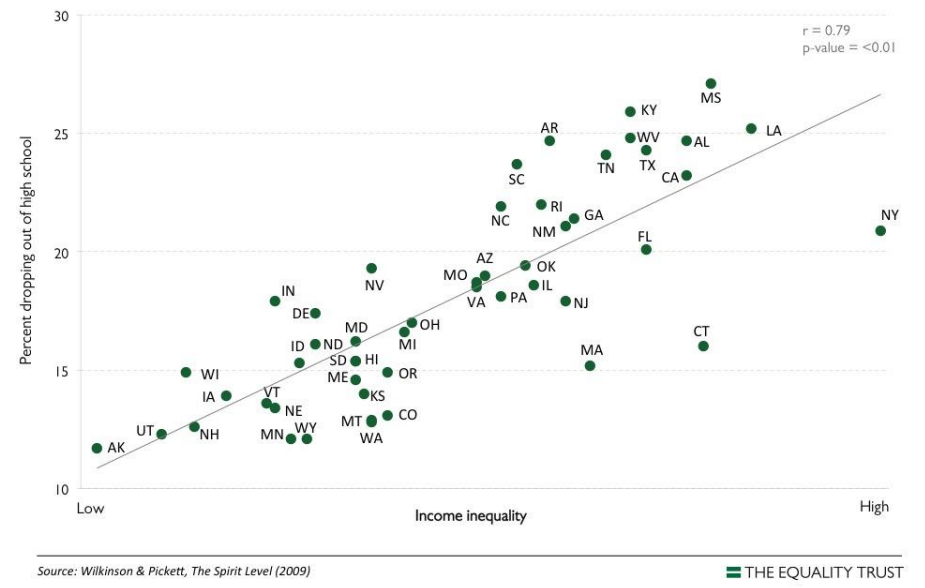

Figure 5.12. More Equal States in the US have a Lower High School Drop Out Rate

Figure 5.13. Homicide Rates are Higher in Countries with More Inequality

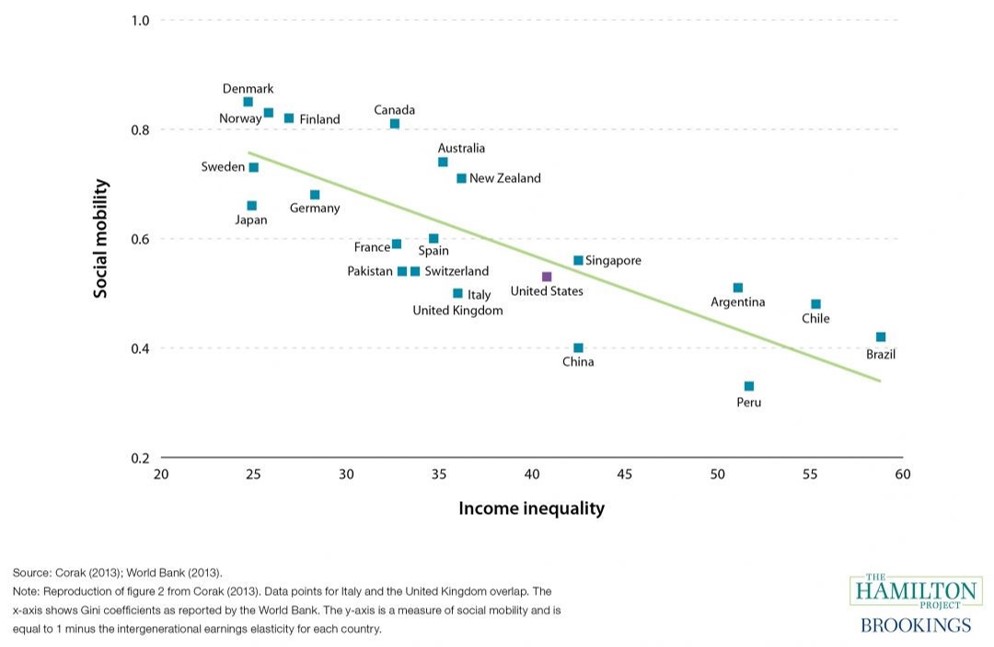

Another data point damaging to the conservative talking point that wealth inequality increases incentives to work harder and pull ones-self up by the bootstraps is the evidence that wealth inequality decreases social mobility. In other words, the more unequal the wealth and income distribution of a country is, the more difficult it is to change your station in life. Thus, the opposite of the conservative narrative is true: wealth inequality disincentives hard work because in more unequal countries it is harder to get ahead, and there is less connection between how hard you work and how much you make.

5.14. Global Social Mobility vs. Wealth Inequality

Source: Brooking Institute[6]

The trend in the US is the same. As wealth inequality has risen since World War II, social mobility has declined precipitously. Today, people born after 1985 (Millennials) have less than a 50% chance of earning more than their parents.

5.15. Percentage of Children Earning More than their Parents by Birth Year

Source: Stanford Center on Poverty & Inequality[7]

The lack of social mobility isn’t because of some sort of social Darwinistic self-sorting, where the rich have risen to the top because of superior genetics and intelligence. When scientists studied the genes predicting academic success and compared them with income, they found that there was no link between genetics and income. In other words, the “good” genes were spread evenly across all income levels. Instead, academic attainment was primarily determined by the income of a child’s father.[8]

It’s not a matter of “lazy Millennials” either. In terms of number of hours worked per week, 2015 data showed US Millennials work an average of 45 hours per week. This is higher than most of western Europe, as well as Australia and Canada. By comparison, Japanese Millennials work 46 per week on average. The countries where Millennials work as many, or more hours tended to be nations with horrific poverty, terrible human rights records, high crime, and either weak or despotic governments (China, Mexico, India, Brazil).[9] Indeed, there appears to be a correlation between wealth inequality, and number of hours worked under awful conditions.

The butcher’s bill for the continual, and rapid, rise of wealth inequality in the United States is starting to come due. In 2017 the US set records for alcohol, drug, and suicide deaths per capita. According to the Centers for Disease Control and two public health non-profits, the national rate for deaths from these causes rose from 43.9 to 46.6 deaths per 100,000 people. This was a 6% increase, according to the Trust for America’s Health and the Well Being Trust. The average rate of increase since 1999 is only 4%, and the figures from 2015-2017 all exceed that by a significant margin, demonstrating an acceleration of the problem. Deaths from suicides rose from 13.9 to 14.5 deaths per 100,000. The 4 percent increase in 2017 was double the average rate in the past decade.[10]

It is worth noting that all of this is occurring in a supposedly “booming” economy with low unemployment. Thus, work truly does not make you free. Quite the opposite; wealth inequality is a huge part of the problem. The truth is that economic inequality destroys opportunity, while forcing people to work harder for less.

The burden of economic inequality is falling hardest on Millennials. They are willing to work far more hours than Gen Xers or Boomers.[11] At the same time, Millennials are the first generation of Americans who have less than a 50-50 chance of being better off than their parents.[12] They are aware of this issue, which is likely why Bernie Sanders message resonated so strongly with them; he was the only major candidate directly addressing this issue. They instinctively know that the Republican message is that laissez fair is the cause of the inequality, and Clinton failed to take the issue head on for fear of sounding too extreme or being branded a socialist.

Why Wealth Inequality is The Death of Democracy

Runaway wealth inequality is not only socially destructive, it is also corrosive to the democratic processes that spawned it in the first place. In short, high levels of wealth inequality are incompatible with democratic governance where the will of the people is executed by their elected representatives. In fact, it may well be impossible. It results in national leadership that may or may not be competent, but definitely ensures that economic systems favor the rich, disfavor everyone else, and create a government unresponsive to the actual desires of the vast majority of the population.

Thomas Piketty estimates that 60% of US wealth (or more if you count “gifts” to offspring) is inherited, This is up from 50% in the 1970’s and 80s.[13] Perhaps no better case study in how inheriting great wealth can easily overcome gross ignorance and incompetence can be found than President Donald J. Trump.

Case Study: Donald Trump

The rich really are very different from you and I, but perhaps not in the way Scott Fitzgerald meant. One of the most amazing, and disturbing things about this entire Presidency is how it so starkly illustrates the overwhelming power of wealth in the United States, and how it makes the rich so very different.

Trump is not a smart man. He’s not intellectually curious. He is, by all accounts, unteachable. About anything. His personality isn’t suited for success either. He is ill-tempered, mercurial, petty, vindictive, and garrulous. He’s not particularly strategic or deep in his thinking, and trusts his “gut” more than facts or deep analysis. He is impervious to information that does not already fit his world view.

He’s not particularly hard working. He rarely starts his official duties before 10 am, and frequently not until 11. He spends 60% of his time in the White House in unstructured “executive time.”[14] His frequent golf junkets to Mar-a-Lago cost more in one year than the all 8 years of travel budget in the Obama Administration.[15]

He is not eloquent. He strings buzzwords and dog-whistles together into a stream of consciousness that only those in tune with his particular brand of knee-jerk conservatism can follow or understand. He has read almost nothing, and cannot even manage to work his way through single page, bullet pointed intelligence briefings.

He’s not a great leader. He pits his subordinates against each other in a belief that “survival of the fittest” will make things work (hint: it doesn’t). He belittles them, mocks them, and turns on them in an instant. He doesn’t listen to them, and when they do speak their minds, he fires them.

He delights in fawning praise, like the staged round table love fest by his cabinet or the acclaim of the evangelical right, who figured out that by harnessing the feelings of their base, and praising Trump as the God-sent savior of America, they would find their ticket to all their Dominionist fever-dreams. The same is true with Fox News; they flatter him, and he agrees with everything they put on the air. Thus, his vanity, pride, and ignorance make him easy to manipulate.

The only “gift” he has is sharing the qualities of pettiness, vindictiveness and cruelty with Republicans who are similarly ignorant, petty, vindictive and racist. He has a remarkable talent for appealing to the lowest common denominator at the right times.

He’s not a great deal maker or businessman. He would have more money if he just dumped his inherited wealth in an indexed stock fund in the 1970’s. He paid $130,000 for two minutes of sex. His Twitter feed is ample evidence of his loose affiliation with the truth and poor impulse control.

He’s not a good human being. Willful ignorance, mocking the disabled, preying on women, lying, cheating on his spouses, cruelty, bullying people, and inciting violence are all examples of his personality.

In almost any alternate universe where he didn’t inherit hundreds of millions of dollars, he would be a spectacularly unsuccessful person. I cannot imagine him holding a job where he had to work with other people. In a business world, he would have been dumped long ago for any of his excesses. Racism, sexism, sexual harassment, bullying, ignorance, unwillingness to learn anything, poor impulse control, lying, and reneging on contracts are all things an employer would fire normal employees for.

Any one of these failings would make someone unemployable in the corporate world. Trump has all of these faults. In a world where he wasn’t born into hundreds of millions of dollars in inherited money, he would be a legal and HR nightmare for any company dumb enough to hire him. If he owned a small or mid-sized business, he would have driven it under, sued for contract violations, and be destitute as a result.

His family life would be a shambles. He wouldn’t stay married for long. He wouldn’t have any money after the divorce. He might even go to prison for failing to pay child support. He’s be that awful relative no one ever wants to have over for Thanksgiving, because he’ll spout racist stuff at your kids, grope your wife, and say vaguely sexual and creepy things about your daughter.

But, because he was born rich, people have had to put up with these failings his entire life. They have had to genuflect to him because of his wealth. They make excuses for him, cater to him and allow him to get away with anything. He never had to learn, or grow.

He never had to consider how or why he has failed at anything. He has never had to ponder how he could be better. He never needed to improve himself, or consider the moral implications or consequences of anything he does. He is the perfect example of how a life utterly devoid of introspection and replete with narcissism is possible because he was born with a silver spoon in his mouth. He also illustrates how meritocracy fails in a system where there are no checks and balances placed on the ultra-rich; they exist above the law and outside the Peter-principle.[16] They do not play by the same rules as the rest of America, and they know it.

What the Research Says About Wealth Inequality and Democracy

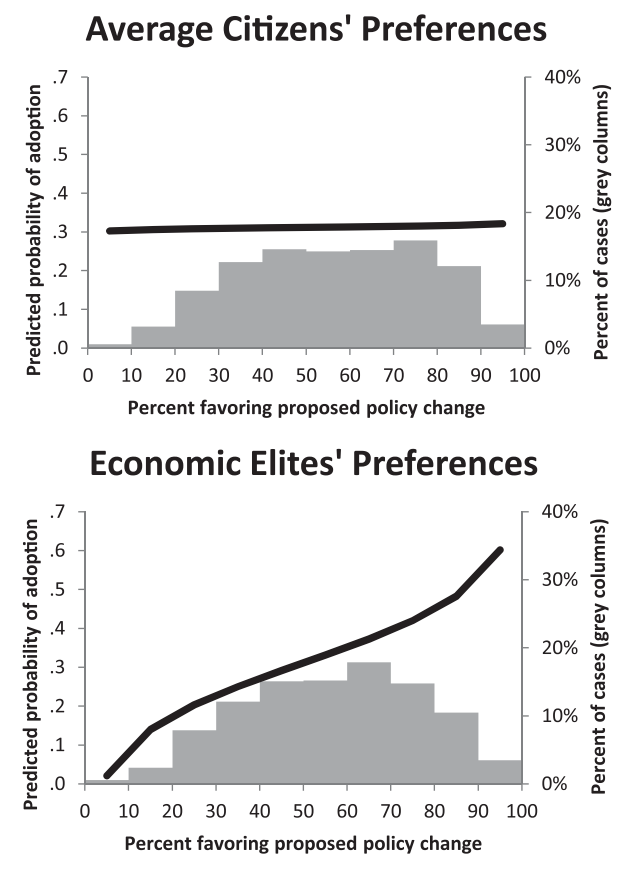

In 2014 Dr. Benjamin Page of Northwestern University and Dr. Martin Gilens at Princeton University shocked the world by publishing a paper which seemed to show quantitatively that the United States was no longer functionally a democracy. They reached this conclusion by comparing the clout of rich Americans (top 10%) vs. the middle 85% on 1779 policy issues between 1980 and 2002. What they found was that whether or not the middle class favored a policy had no statistical impact on whether it was adopted. However, the opinions of the wealthiest 10% had a dramatic impact on whether or not the policy was adopted.

Figure 5.16. Effect of Wealth on Policy Implementation

Source: Gilens and Page[17]

It’s not hard to think of cases where the American public feels very strongly about an issue, but money and interests override the popular will. This includes even the simplest forms of gun control (88% of the populatin support it post-Sandy Hook), protections for LGBT people (~70% support), and the Trump Tax Cut (which passed with only 29% support in December 2017).[18]

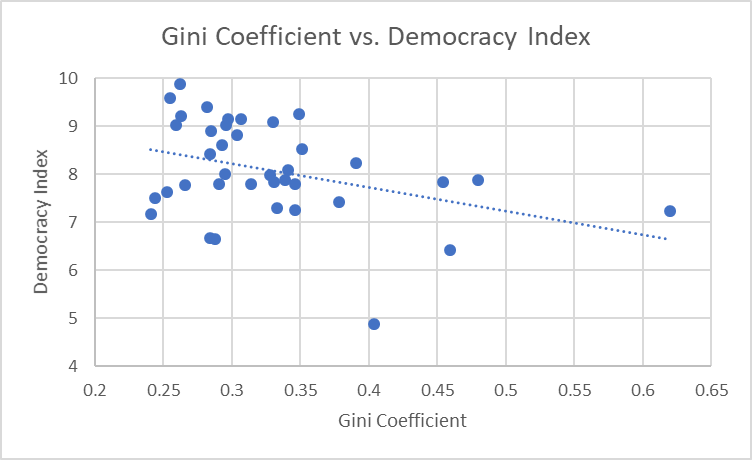

If you look at Gini Coefficient vs. the Democracy Index scores of OECD nations, there is a statistically significant (p = .022) relationship between how unequal wealth within a country is, and how democratic its government is. The democracy index ranges from zero (perfectly totalitarian state) to a perfectly democratic one at 10 (Norway has the top score at 9.87).

Figure 5.17. Gini Coefficient vs. Democracy Index

Data Sources: Economist Intelligence Unit (Democracy Index), OECD (Gini coefficient)

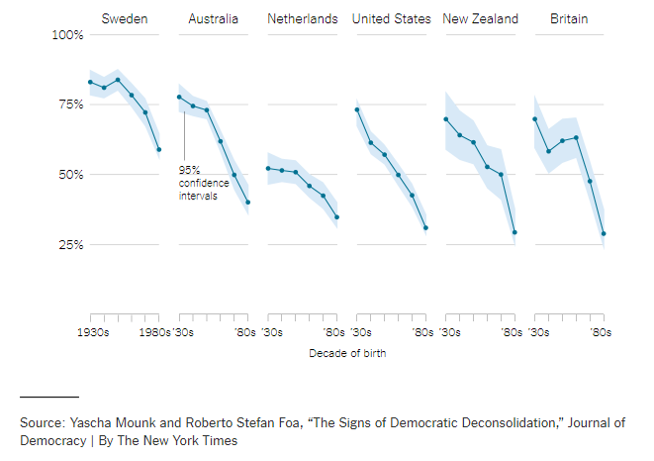

Other studies have shown that high levels of wealth inequality reduce support for democracy.[19] This fits the pattern we see in the US, and elsewhere around Europe, where wealth inequality has increased as support for democracy has decreased. We also see the lowest level of support for democracy amongst younger people, who are the hardest hit by the issue of unequal wealth distribution.[20] Another, researcher, Paul Howe, looked at this same data set and concluded, “Disregard for democratic norms is part of a larger social transformation that has seen rising disengagement and alienation, particularly among younger generations and lower socioeconomic classes..”[21]

Figure 5.18. Percentage Whose Say it is “essential” to Live in a Democracy

The view that massive disparities in wealth endanger democracy is held by many subject matter experts, and the data presented here seems to support this hypothesis. The mechanism for this effect is not hard to understand. “It’s very dangerous,” said Ngaire Woods, dean of the Blavatnik School of Government at the University of Oxford. “If people can’t aspire to succeed within the system, they will aspire … outside the system, in ways that break the system.”[22]

These experts point out that by 2030, the top 1% of the population will earn 37-40% of the country’s income. The bottom percent will earn 6%. Nick Hanauer, a former venture capitalist and now head of Civic Ventures, summed up what this sort of disparity represents. “That’s not a capitalist market economy anymore. That’s a feudalist system.”

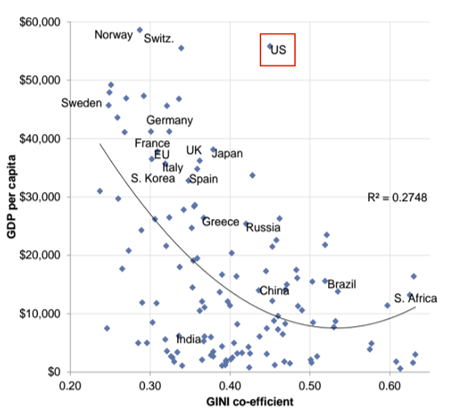

Indeed, when comparing GDP per capita to GINI coefficient, the US is an outlier with a higher than average GDP per capita and higher GINI coefficient. However, economic growth for the middle class and poor has stalled out or reversed, and the fact that the US is becoming less democratic may be a phenomena known as reverting to the mean. In other words, while the US is different now, the response is to become more like countries that are similar in other ways. In this case, the US is becoming more like Russia, China, and Brazil politically because in some ways it resembles them economically.

Figure 5.19. Gini Coefficient vs. Per Capita GDP

Source: CIA World Fact Book

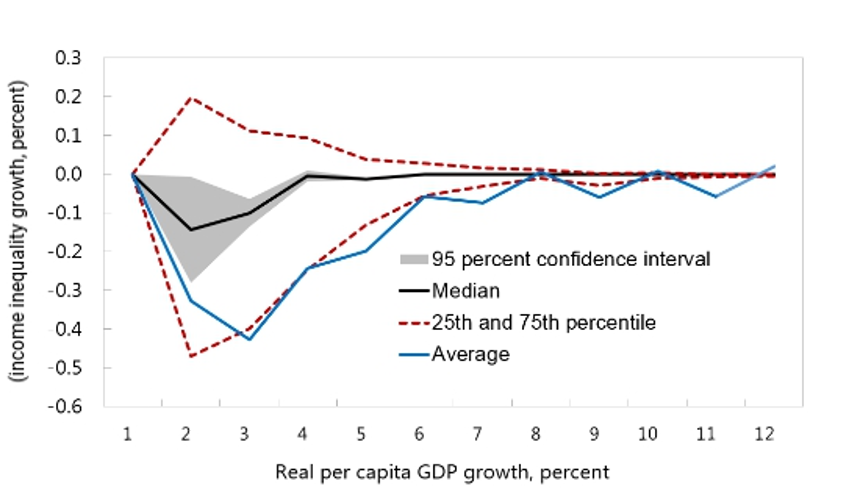

Indeed, if a capitalist system with a healthy middle class and strong consumer spending as an economic driver is the intended goal of US economic policy, wealth inequality works against it. Research shows that high levels of economic inequality inhibit growth. When the International Monetary Fund studied the issue, they found that high levels of wealth inequality create significant economic drag. Extremely low levels of wealth inequality reduce economic growth to a lesser extent, but the US is far above the .27 Gini coefficient threshold where there appears to be a “Goldilocks zone” for inequality.[23]

Figure 5.20. Wealth Inequality Generally Negatively Impacts Economic Growth Source: Grigori, et al (2016)

Source: Grigori, et al (2016)

The chart above shows that as wealth inequality grows, GDP growth is lower. This makes sense intuitively. If the only people able to afford niceties are a very select few, and everyone else is barely capable of making ends meet, this represents a disaster for retailers. We can see this effect with Millennials and their spending habits. While Millennials have been accused of “killing” numerous businesses and industries, it’s not their fault. The Federal Reserve studied this and concluded the reason Millennial aren’t buying things is simply because they do not have the disposable income to buy the things Gen X and the Boomers did, which is part of the rising wealth inequality phenomenon.[24]

Republicans / Conservatives (Mostly) Created this Issue

A question people would ask is who is to blame for the rise of economic inequality, and all the ills that come with it. While Democrats can take some of the blame for failing to emphasize policies that reduce wealth inequality, the Republican party, and its base (corporations and religious conservatives) are the ones actually demanding policies that exacerbate the problem.

The list of positions that contribute to worsening economic disparities reads like a conservative letter to Santa: low top marginal tax rates, low taxes on corporations, slashing the social safety net (Medicare, social security, Medicaid, Affordable Care Act, WIC, etc…), opposition to unions, weakened labor laws, opposition to raising the minimum wage (or having a minimum wage at all), the Bankruptcy Reform Bill of 2005[25], and acceptance of medical bankruptcy as simply a price of “freedom.” An entire book could be written on how each of these positions contributes toward wealth inequality. Indeed, there are numerous studies on the effect of each individual factor.

Suffice it to say, however, that each is effectively the government acting as a reverse Robin Hood, taking from the poor and giving to the rich and corporations. Individually, any one of these is not enough to create the runaway wealth inequality we see now. Together, however, they are sufficient to create the freefall we observe across society. Conversely, fixing one of these problems (say, the top marginal tax rate) would not be sufficient to overcome the effects of all the others.[26] While conservatives use this to effectively argue, “Welp, that won’t fix everything, so lets not do it,” we are effectively on a path to middle class social, governmental, and economic oblivion (unless you really want to live in a theocratic oligarchy).

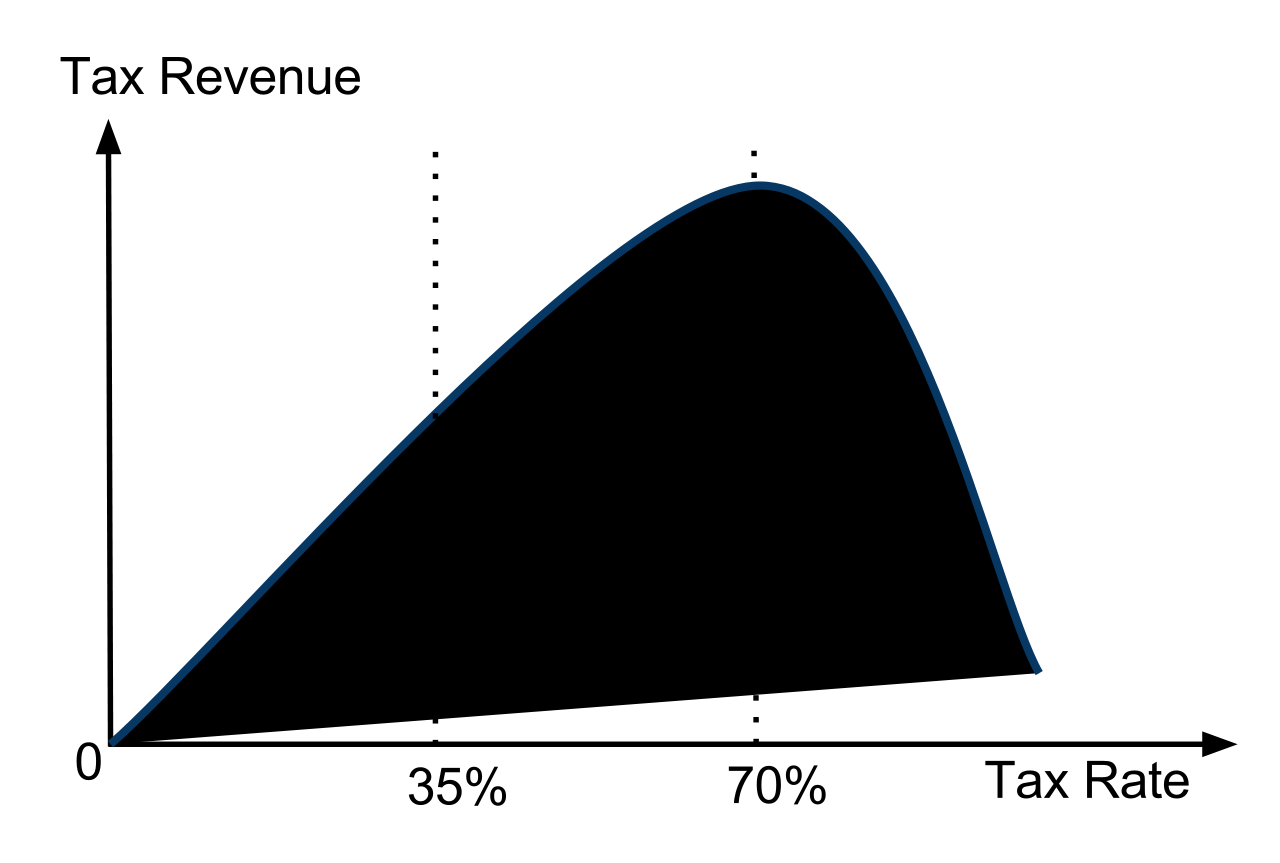

Thus, halting the runaway train to Oligarchyville will take an “all of the above” strategy. Each and every one of the things necessary is vehemently opposed by the Republican party, while generally favored by the majority of the public. 82% of the public wants to raise the minimum wage, and 55% want to more than double it to $15 per hour.[27] 59% of registered voters support raising the top marginal rate on people earning more than $10 million per year to 70%. Only 12% of Americans want to see cuts to Medicare and Social Security.[28] The Affordable Care Act is significantly more popular than the Trump Tax cuts for the wealthy.[29] Support for labor unions is at a 15 year high, and has been rising since 2008.[30] Indeed, modern analysis suggests that tx revenue is maximized at about 70%, even accounting for economic growth.

Figure 5.21. Estimated Laffer Curve Peak Is Approximately 70% Source: Trabandt, Mathias; Uhlig, Harald (2011). “The Laffer Curve Revisited”[31]

Source: Trabandt, Mathias; Uhlig, Harald (2011). “The Laffer Curve Revisited”[31]

Despite virtually every Republican economic policy being wildly unpopular with the general public, and contributing to worsening social and economic conditions for most Americans, they still pursue these goals. Why? Because corporations and Republican politicians have convinced their religiously conservative base that these policies are what God wants (along with some out and out racism).

WEALTHINESS is Next to Godliness

During Ronald Reagan’s 1976 run for President in the primaries against Gerald Ford, he gave a speech which is credited with popularizing the term “welfare queen.” He cited a single instance of a woman who scammed the system in the United States with over 80 aliases and at least four fake dead husbands.[32] Based on this anecdote, Reagan promised to fix the welfare system by deterring people from using it. The term “welfare queen” became a racial short-hand dog whistle in the 1980’s to evoke images of the lazy, indigent black person scamming the system who has no right to government assistance.

The theme of racial dog whistles to undermine government assistance continued as Reagan made references to “some strapping young buck,” during message testing to southerners. He did it in the context of building a mental image of an able-bodied black man using food stamps to buy steak while everyone else worked for a hamburger. The racist messages directed at white southerners were ridiculously effective: even Bill Clinton, as a centrist democrat, used this false stereotype of overly generous welfare benefits to gut them in the bipartisan Welfare Reform Act of Personal Responsibility and Work Opportunity Reconciliation Act of 1996.

At its heart, this stereotype played to the current Republican base: the religious right and the more secular hard-right which is built around racial grievances. The religious right also has a distinctly racist streak: it is primarily built around white evangelicals (who are concentrated in the US South). The Southern Baptist Convention, the largest protestant denomination in the US, was founded on providing biblical justification for slavery during pre-Civil War debates on the issue. During the Civil Rights Movement, they again were responsible for providing the biblical justification for segregation and using religion as a way to opt out of civil rights laws.

Over time, the evangelical right has come to believe, more than any other religious group, that people are poor because they are lazy or sinful.[33] Indeed, white evangelicals are more than twice as likely as non-Christians to believe people are poor because they are lazy. Conversely, white evangelicals believe that wealth is a sign of divine favor for leading a good life. Forty percent of white evangelicals (again, more than any other group surveyed) believe in the “prosperity gospel,” which teaches that people who give money to churches will be rewarded by God with more wealth.[34] President Trump has kept huckster proponents of the prosperity gospel (such as Paula White) close to his administration and in his inner circle of religious figures with access.[35]

Finally, there is something of an “I’ve got mine” aspect to support for reverse Robin Hood policies that is also associated with the base of the Republican party. Nate Silver of FiveThirtyEight.com found, perhaps counter intuitively, Trumps supporters were wealthier than the average American. This makes sense, given that they are older, whiter, and less likely to be queer than the general population (all of which make people more likely to be financially secure.) [36]

All of this adds up to a worldview in which God supports all the policies that make wealth inequality worse. Poor people shouldn’t get assistance because they are lazy and sinful. In turn, this feeds the racist paradigm that minorities are poor because they are lazy, stupid, or sinful. At the same time, there is a belief that slashing benefits encourages hard work, even though the economic data we have shows that people are working more and more hours at more and more jobs. Rich people worked hard for their money, and God is rewarding them for their hard work. Thus any sort of taxes on the rich are an attempt to undo the will of God, or is punishing “hard work.”

In turn, conservative corporations and the wealthy have worked hard to encourage the “pull yourself up by the bootstraps” narrative that anyone can get rich if they simply work hard enough, which bolsters white evangelical the religious belief that morality in the form of work ethic determines personal economic success. It also dovetails with the observation that demographic groups associated with Republicans are far more likely to believe that poverty is caused by personal faults rather than circumstance, along with the converse. Rakeen Mabud, the director of the Roosevelt Institute’s 21st Century Economy and Race and Gender programs, puts the lie to this narrative, however.

“Conservative lawmakers have long been selling the misleading notion that Americans can change their destinies simply by working themselves to the bone, distracting from the structural forces that make economic upward mobility extremely difficult. But the truth is that in America today, hard work can get most people only so far. In fact, those who are working hardest have fallen behind the fastest. These days, working as a home health aide, a restaurant worker, or in any minimum-wage job is not a gateway to the middle class. According to some reports, a quarter of all individuals living in poverty are working or seeking work, and in many states, people working full time at minimum wage still live below the poverty line.” [37]

However, any hope that Republicans might actually take the steps necessary to turn things around for Millennials and Gen Z are entirely misplaced. Leading conservative religious figures like Franklin Graham denounce any attempt to raise tax rates, empower unions, or raise minimum wage laws as “godless” and “evil.” socialism[38] FiveThirtyEight’s analysis observed that the US is probably too religious to institute the progressive economic policies necessary to turn the tide.[39] Given the Republican stranglehold on the US Senate due to non-proportional representation, the odds of getting enough votes to raise tax rates, close corporate loopholes, protect unions, guarantee health care, and bolster the social safety net are just about zero.

Historically, the precedents for reversing these trends in wealth inequality only come in one of two flavors. The first is to use the political system to institute the sorts of reforms necessary to empower workers, while preventing corporations and the wealthy from rent seeking behaviors. Rent Seeking is defined as individuals or companies using resources to obtain economic gain without reciprocating any benefits to society through wealth creation. An example would be lobbying the government for loan subsidies, tax breaks, grants, or tariff protections. FDR’s New Deal and LBJ’s Great Society are examples of such governmental action to reduce inequality. However, given the state of the US political system, its demographics, and the Senate representing the people non-proportionally, there is precisely zero chance this will happen.

The other historical example of how to raise the value of labor, and overall standard of living, is to kill a large percentage of your workforce. The lowest level of wealth inequality in the US in modern history came not during the New Deal, but starting in the early 1940’s when we went to war, lost 407,000 men, and another 671,000 came back wounded. This trend held true for virtually every country after WWII.

Other historians credit the Plague (aka The Black Death), which killed 1/3rd of the people in Europe and hit Italy the hardest, with reducing inequality more than any other event in Western history. Indeed, historian Dr. Walter Scheidel makes the argument that violence and catastrophes (like the plague) are the most effective ways to reduce inequality, and that the Renaissance was only possible because of the preceding pandemic.[40] Thus, he looks at the situation in the US with regards to inequality, and finds it irreversible without violence and catastrophe sufficient to nearly collapse society. His observations generally fit well with the social and econometric analysis above.

As I discuss in the next chapter, however, Republicans have entrenched themselves into permanent single party rule throughout the United States, and created an illiberal democracy where election results are pre-determined, which suggests that only revolution or mass die offs will answer the question of how wealth inequality in the US (and all the ills that come with it) could be reversed.

[1] Chetty, R., Grusky, D., Hell, M., Hendren, N., Manduca, R., & Narang, J. (2016). The Fading American Dream: Trends in Absolute Income Mobility Since 1940. Science. doi:10.3386/w22910

[2] http://www.aei.org/wp-content/uploads/2012/06/-a-new-measure-of-consumption-inequality_142931647663.pdf

[3] https://www.cia.gov/library/publications/the-world-factbook/rankorder/2172rank.html

[4]Wesley, E., Peterson, F., (2017) Is Economic Inequality Really a Problem? A Review of the Arguments. University of Nebraska Social Sciences December 2017 DOI: 10.3390/socsci6040147

[5] Wilkinson, R., & Pickett, K. (2009). The spirit level: Why more equal societies almost always do better. London: Allen Lane. p. 18

[6] https://www.brookings.edu/wp-content/uploads/2016/06/THP_13EconFacts_FINAL.pdf

[7] https://inequality.stanford.edu/sites/default/files/fading-american-dream.pdf

[8] https://www.nber.org/papers/w25114.pdf

[9] McCarthy, Niall. Where the World’s Millennials Work The Longest Hours. Forbes Magazine. Retrieved December 31, 2018 from https://www.forbes.com/sites/niallmccarthy/2016/05/26/where-the-worlds-millennials-work-the-longest-hours-infographic/#6499dfec3b9a

[10] O’Donnell, Jayne. “U.S. Deaths from Alcohol, Drugs and Suicide Hit Highest Level since Record-Keeping Began.” USA Today, Gannett Satellite Information Network, 5 Mar. 2019, www.usatoday.com/story/news/health/2019/03/05/suicide-alcohol-drug-deaths-centers-disease-control-well-being-trust/3033124002/?fbclid=IwAR2uzjHeGLUK_seFv96G7PRBgGwNlD_aRhS61e2WA4uZVP_n6yXo0VemYMo

[11] Carmichael, Sarah. Millennials Are Actually Workaholics, According to Research. Harvard Business Review. Retrieved on December 31, 2018 from https://hbr.org/2016/08/millennials-are-actually-workaholics-according-to-research

[12] Chetty, R., Grusky, D., Hell, M., Hendren, N., Manduca, R., & Narang, J. (2016). The Fading American Dream: Trends in Absolute Income Mobility Since 1940. Science. doi:10.3386/w22910

[13] Alvaredo, F., Garbinti, B., & Piketty, T. (2017). On the Share of Inheritance in Aggregate Wealth: Europe and the USA, 1900-2010. Economica, 84(334), 239-260. doi:10.1111/ecca.12233

[14] McCammond, A. and Swan, J. (2019). Scoop: More Trump schedules leaked as enraged officials launch internal hunt. Axios. Available at: https://www.axios.com/trump-schedule-leaks-4840f751-e663-49c0-b288-2dd39bde9c79.html [Accessed 5 Mar. 2019]

[15] Harwell, D., Brittain, A. and O’Connell, J. (2019). Trump family’s elaborate lifestyle is a ‘logistical nightmare’ — at taxpayer expense. [online] Washington Post. Available at: https://www.washingtonpost.com/business/economy/trump-familys-elaborate-lifestyle-a-logistical-nightmare–at-taxpayer-expense/2017/02/16/763cce8e-f2ce-11e6-a9b0-ecee7ce475fc_story.html?utm_term=.7c7e0441b41c [Accessed 5 Mar. 2019].

[16] The Peter principle is a concept in management developed by Laurence J. Peter, which observes that people in a hierarchy tend to rise to their “level of incompetence”. In other words, an employee is promoted based on their success in previous jobs until they reach a level at which they are no longer competent, as skills in one job do not necessarily translate to another.

[17] Gilens, M., & Page, B. I. (2014). Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens. Perspectives on Politics, 12(03), 564-581. doi:10.1017/s1537592714001595

[18] https://news.gallup.com/poll/243611/disapprove-approve-2017-tax-cuts.aspx

[19] Krieckhaus, J., Son, B., Bellinger, N., & Wells, J. (2013). Economic Inequality and Democratic Support. The Journal of Politics, 76(1), 139-151. doi:10.1017/s0022381613001229

[20] Foa, R. S., & Mounk, Y. (2017). The Signs of Deconsolidation. Journal of Democracy, 28(1), 5-15. doi:10.1353/jod.2017.0000

[21] Howe, P. (2017). Eroding Norms and Democratic Deconsolidation. Journal of Democracy, 28(4), 15-29. doi:10.1353/jod.2017.0061

[22] https://www.reuters.com/article/us-democracy-wealth-inequality/growing-wealth-inequality-dangerous-threat-to-democracy-experts-idUSKCN0XC1Q2

[23] Grigoli, F. et al. (December 16, 2016) Inequality and Growth : A Heterogeneous Approach. International Monetary Fund.

[24] Kurz, Christopher, Geng Li, and Daniel J. Vine (2018). “Are Millennials Different?,” Finance and Economics Discussion Series 2018-080. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2018.080.

[25] The Bankruptcy Reform Act of 2005 made it effectively impossible to ever get student loan debt discharged.

[26] Denning, S. (2019, February 26). Why A 70% Marginal Tax Rate Won’t Fix Inequality. Retrieved from https://www.forbes.com/sites/stephaniedenning/2019/02/25/why-a-70-marginal-tax-rate-wont-fix-inequality/

[27] Sheffield, M. (2019, January 24). Poll: Majority of voters support $15 minimum wage. Retrieved from https://thehill.com/hilltv/what-americas-thinking/426780-poll-a-majority-of-voters-want-a-15-minimum-wage

[28] Gramlich, J., & Gramlich, J. (2017, May 26). Few Americans support cuts to most government programs. Retrieved from http://www.pewresearch.org/fact-tank/2017/05/26/few-americans-support-cuts-to-most-government-programs-including-medicaid/

[29] Kelly, E. (2018, August 23). Fox News poll: Voters like Obamacare more than GOP tax cuts. Retrieved from https://www.usatoday.com/story/news/politics/onpolitics/2018/08/23/fox-news-poll-obamacare-gop-tax-cuts/1074570002/

[30] Gallup, Inc. (2018, August 30). Labor Union Approval Steady at 15-Year High. Retrieved from https://news.gallup.com/poll/241679/labor-union-approval-steady-year-high.aspx

[31] Trabandt, Mathias; Uhlig, Harald (2011). “The Laffer Curve Revisited”. Journal of Monetary Economics. 58 (4): 305–27. doi:10.1016/j.jmoneco.2011.07.003

[32] Levin, J. (2013, December 19). The Real Story of Linda Taylor, America’s Original Welfare Queen. Retrieved from http://www.slate.com/articles/news_and_politics/history/2013/12/linda_taylor_welfare_queen_ronald_reagan_made_her_a_notorious_american_villain.html

[33] Zauzmer, J. (2017, August 03). Christians are more than twice as likely to blame a person’s poverty on lack of effort. Retrieved from https://www.washingtonpost.com/news/acts-of-faith/wp/2017/08/03/christians-are-more-than-twice-as-likely-to-blame-a-persons-poverty-on-lack-of-effort/?utm_term=.009827d34d74

[34] Smietana, B. (2018, July 31). Prosperity Gospel Taught to 4 in 10 Evangelical Churchgoers. Retrieved from https://www.christianitytoday.com/news/2018/july/prosperity-gospel-survey-churchgoers-prosper-tithe-blessing.html

[35] Duin, J. (2017, November 14). She led Trump to Christ: The rise of the televangelist who advises the White House. Retrieved from https://www.washingtonpost.com/lifestyle/magazine/she-led-trump-to-christ-the-rise-of-the-televangelist-who-advises-the-white-house/2017/11/13/1dc3a830-bb1a-11e7-be94-fabb0f1e9ffb_story.html

[36] Silver, N. (2016, May 03). The Mythology Of Trump’s ‘Working Class’ Support. Retrieved from https://fivethirtyeight.com/features/the-mythology-of-trumps-working-class-support/

[37] Gramlich, J., & Gramlich, J. (2017, May 26). Few Americans support cuts to most government programs. Retrieved from http://www.pewresearch.org/fact-tank/2017/05/26/few-americans-support-cuts-to-most-government-programs-including-medicaid/

[38] Fox Business News, Retrieved February 26, 2019 https://www.facebook.com/FoxBusiness/videos/vb.12795435237/10153878971005238/?type=2&theater

[39] Lewis, A. R., & Djupe, P. A. (2016, March 10). Americans May Be Too Religious To Embrace Socialism. Retrieved from https://fivethirtyeight.com/features/americans-may-be-too-religious-to-embrace-socialism/

[40] Scheidel, W. (2018). The great leveler violence and the history of inequality from the Stone Age to the twenty-first century. Princeton, NJ: Princeton University Press.

The SCOTUS Event Horizon for the LGBT Movement

Stop for a moment. Imagine how bad it will be…